Making the Most of Your Final Decade Before Retirement

Prepare for a fulfilling retirement with Christian financial advisors. We guide you through purpose, planning & legacy in your final 10 years before retirement.

The decade before retirement represents a critical planning period - perhaps the most important time for ensuring a smooth transition into your retirement years. With major life transitions on the horizon, decisions made during these years can significantly impact your retirement success.

At Peak Financial Management, effective retirement planning requires both technical excellence and a values-based approach that considers what matters most to you.

As Christian financial advisors who approach our work from a stewardship perspective, we recognize that wise management of resources is both prudent and an expression of faith.

Our framework centers around what we call the "Three P's" of retirement preparation: Purpose, Planning, and Passing It On.

At Peak Financial, we believe financial planning isn't about following a specific set of 'Christian rules' for money management. Rather, it's about recognizing that following Jesus with what He has entrusted to you comes first.

While we offer technical guidance based on sound principles, we understand that faithful stewardship ultimately means being responsive to Christ's leading in your life. This might look different for each person, which is why our planning process creates space for both prudent management and personal conviction.

Purpose: Retire TO Something, Not FROM Something

Many people focus exclusively on the financial aspects of retirement without considering what will fill their days when work no longer structures their time. This oversight can lead to dissatisfaction, strain on marriages, and even health issues.

Consider these eye-opening statistics:

- Delaying retirement by just one year increases life expectancy by 11% on average

- About 20% of retirees return to work within six months of retiring (source)

- Approximately 45% of retirees continue working for social and emotional benefits

These numbers reveal an important truth: humans were designed for productivity and purpose. Without meaningful activities and goals, retirement can quickly become unfulfilling.

Instead of viewing retirement as simply an escape from work, at Peak, we encourage our clients to develop a vision for what they're moving toward.

Consider these approaches:

- Gradual Off-Ramp: Rather than stopping work completely, consider reducing hours gradually. This allows you to maintain social connections, purpose, and income while creating opportunities to develop new interests. In many cases, this approach also helps those who will succeed you in your role make a better handoff.

- Sabbatical Approach: Some clients benefit from taking an extended break (3-6 months) to reassess before fully committing to retirement. This "trial retirement" often provides valuable insights about what permanent retirement might feel like.

- Alternative Work-Rest Rhythms: Perhaps full retirement isn't your goal. Consider creating a customized schedule that might include working 10 months with 2 months off, or working 3 days per week indefinitely.

- Structured Engagement: Develop a regular schedule of volunteer work or community engagement that provides structure and purpose without traditional employment. This might include serving on boards, mentoring younger professionals, or dedicating set hours to causes you care about.

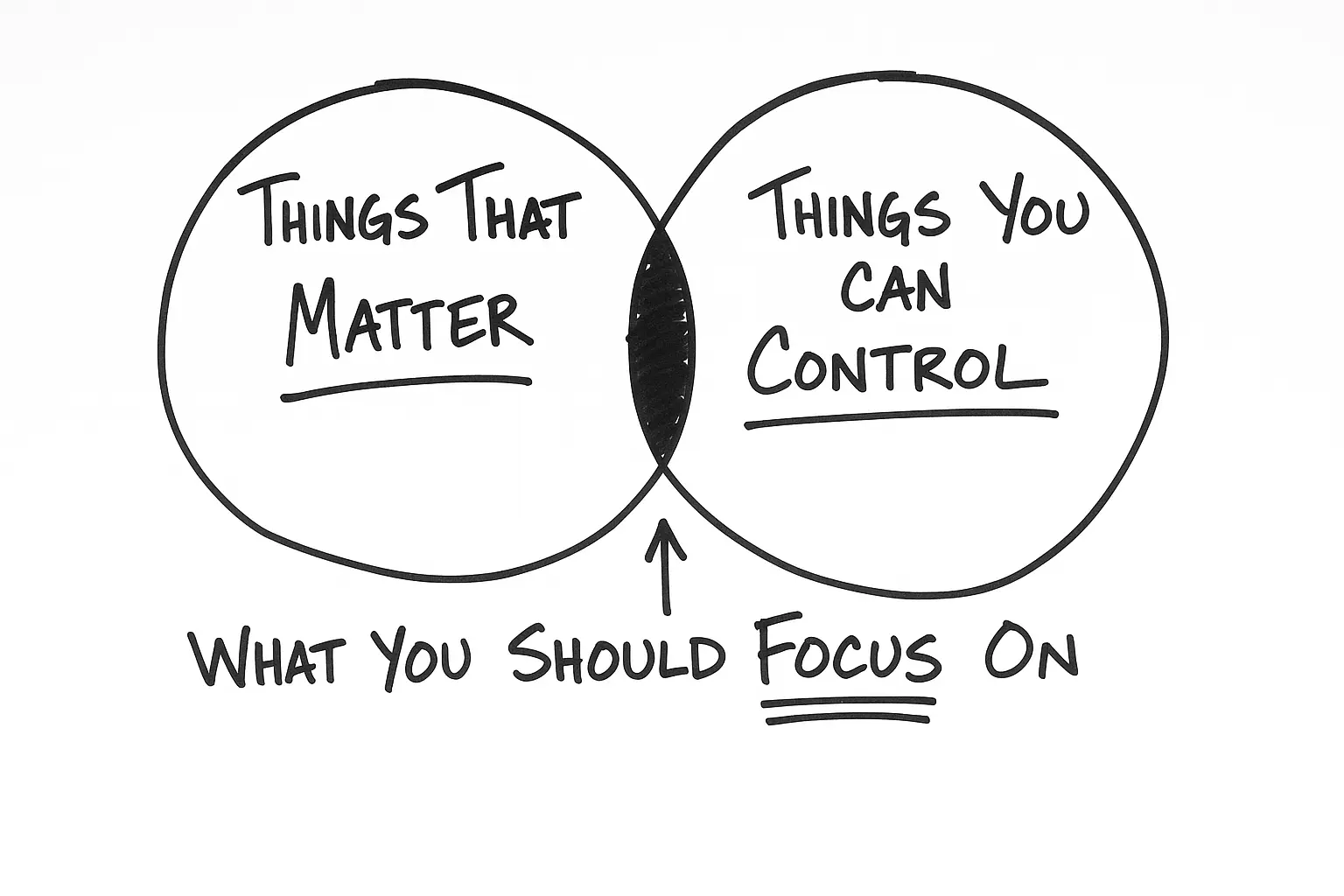

Your retirement plan should include strategies to maintain emotional health during market volatility and economic uncertainty. During turbulent times, it's crucial to have specific approaches for managing your wellbeing. This might include limiting how often you check your portfolio, engaging in stress-reducing activities, maintaining perspective through conversations with trusted advisors, or temporarily focusing on non-financial activities that bring fulfillment.

Working with a professional wealth advisor who can monitor your finances during turbulent times allows you to focus on the long-term big picture rather than being distracted by day-to-day market movements, while protecting yourself from making emotionally-driven decisions that could harm your financial future.

Planning: Building a Solid Foundation

Effective retirement planning requires balancing growth, protection, and optimization. We think of these as offense, defense, and fine-tuning.

Offense: Growth Strategies

Many retirees become overly conservative with investments too early. Remember that retirement may last 20-30 years, requiring continued growth to outpace inflation and support your lifestyle.

Understanding the "retirement spending horseshoe" can help with proper allocation planning. Many people without professional guidance rely on the "Safe withdrawal rate" approach (the traditional 4% rule), which assumes linear, consistent spending throughout retirement. However, most retirees actually experience higher spending in early retirement (travel, activities) and again in later years (healthcare), with a dip in between. Your investment approach should account for this pattern rather than assuming linear drawdown.

Your investment allocation should be personalized based on your specific situation, risk tolerance, and goals - not based on generic rules of thumb or age-based formulas.

Defense: Risk Management

Protecting what you've built becomes increasingly important as you approach retirement. Key defensive strategies include:

- Eliminating Debt: Paying off mortgages and other debt before retirement reduces fixed expenses and increases financial flexibility.

- Healthcare Planning: Medicare begins at 65, but understanding supplemental coverage options, Medicare Advantage plans, or Medigap policies is essential for managing healthcare costs.

- Long-Term Care Considerations: Have you accounted for potential long-term care needs? These costs can dramatically impact your financial picture and should be addressed proactively.

- Legal Preparations: Ensure powers of attorney (medical and financial) are in place, along with advance directives and current estate documents.

- Insurance & Liability Planning: As you approach retirement, you likely have more assets than ever before—which means you have more to lose if someone sues you. Review your liability coverage, umbrella policies, and other protective measures to protect your wealth.

- Behavioral Discipline and Flexibility: Your own financial behavior is one of the most powerful factors affecting your retirement security. This includes two critical elements:

1. Investment discipline: Avoiding panic selling during market downturns and maintaining consistent investment contributions despite volatility.

2. Spending flexibility: Being willing and able to adjust your discretionary spending during market downturns or unexpected emergencies. This flexibility is often overlooked but can be one of your most powerful tools for navigating financial challenges without depleting your retirement savings during difficult periods.

- Diversify Income Sources: While Social Security can be an important component of retirement income, building sufficient personal savings creates greater financial independence. When your income comes from multiple sources within your control, you gain flexibility and reduce uncertainty about potential changes to government programs.

Optimization: Making the Most of What You Have

Fine-tuning your retirement strategy involves maximizing efficiency across various technical aspects:

- Social Security Timing: When to claim benefits can significantly impact lifetime income. For married couples, especially, coordinated claiming strategies may increase total benefits.

- Withdrawal Sequencing: Which accounts you draw from first (taxable, tax-deferred, or tax-free) can dramatically affect your tax situation and portfolio longevity.

- Tax Planning: Strategic Roth conversions, bracket management, and other tax techniques can reduce your lifetime tax burden.

- Giving Strategies: For those charitably inclined, approaches like qualified charitable distributions or donor-advised funds can multiply the impact of your giving while providing tax benefits. This is especially important for business owners approaching retirement – incorporating charitable strategies before the sale of your business creates unique tax advantages that aren't available afterward. Once this opportunity is missed, there isn't a second chance, so planning ahead is crucial.

Evaluating Expectations vs. Resources

One of the most valuable exercises during your final working decade is honestly assessing whether your retirement lifestyle expectations align with your accumulated resources. This rigorous evaluation is a cornerstone of effective retirement planning final decade strategies, as it highlights why those last 10 years are so critical.

This evaluation provides:

- Time to increase savings if needed - When you discover gaps early, even modest increases in savings can make a significant difference

- Opportunity to adjust expectations before retirement begins - Small adjustments made gradually feel manageable rather than painful

- Clarity about what trade-offs might be necessary - Understanding potential compromises helps you prioritize what truly matters

Without this assessment, many retirees face a jarring reality check only after they've stopped working—when options for correction are limited. As we often say, "It's better to make small adjustments now than slam on the brakes when retirement arrives."

At Peak Financial Management, we facilitate this assessment through regular meetings that increase in frequency as retirement approaches. In the final year before retirement, we often meet 3-4 times to refine assumptions, test scenarios, and ensure alignment between expectations and resources.

This process helps prevent the uncomfortable experience of discovering misalignment only after retirement has begun. By asking the crucial question—"Are my expectations of retirement matched with the resources I've saved?"—we help you enter retirement with confidence rather than concern.

Passing It On: Preparing for the Future

The final component of comprehensive Christian retirement planning involves considering what happens to your resources after you're gone. As stewards rather than owners of what we've been given, thinking about the next manager of these resources is an important responsibility.

- Choose Your Next Steward: Have you intentionally determined who should inherit your assets? Beyond simply naming beneficiaries, have you considered whether these individuals are prepared to manage what they'll receive?

- Prepare Your Heirs: Inheritance can be either a blessing or a burden, depending on the recipient's preparation. Consider how you might help prepare those who will eventually receive your assets.

- Consider Charitable Impact: Many clients find great satisfaction in including charitable organizations in their estate plans. Testamentary giving (gifts made through your will or trust) can create lasting impact for causes you care about.

Remember that your legacy planning should align with your values and what matters most to you.

A Note on Personal Direction

While we've outlined general principles for wise financial management, our faith-based financial advice acknowledges that each person's situation is unique. Your values, goals, and personal convictions all matter deeply in how you manage your resources

In our experience, good financial planning recognizes both the wisdom of prudent financial management and the imperative to follow God's specific leading in your life. Scripture offers us seemingly contrasting examples – the prudent steward who faithfully manages resources over time (Proverbs 21:20) alongside the widow who gives her last coins as an act of faith (Mark 12:41-44).

These aren't contradictory teachings but rather complementary aspects of faithful stewardship. Prudent financial management creates the foundation that allows you to respond generously when God prompts specific action. By building a solid financial base through wise planning, you create the margin needed to be radically obedient in specific circumstances. Far from being opposites, prudence and faith work hand-in-hand in effective financial planning.

The Value of Professional Guidance

As retirement approaches, financial decisions become more complex and interconnected. This is why our process at Peak Financial intensifies during your final working years.

We typically meet twice yearly leading up to retirement. In the final year before retirement, we often increase to 3-4 meetings to ensure everything is carefully calibrated. Our process includes:

- Regular review meetings that increase in frequency as retirement nears

- Testing multiple retirement scenarios with different variables

- Aligning your investment, income, and tax strategies

- Continuous refinement of assumptions to match your evolving plans

- Regular reassessment of whether your expectations align with your resources

We serve as a thinking partner during this critical transition, helping you navigate both the technical aspects and the personal dimensions of this significant life change.

Next Steps

The final decade before retirement provides a critical window for preparation, but it's never too late to start planning wisely. Whether you're just beginning to think about retirement or are already in your final working years, taking action now can significantly improve your outlook.

We invite you to schedule a 25-minute discovery conversation with one of our Certified Kingdom Advisors© to explore how we might help you prepare for this important transition. During this complimentary call, we'll discuss your specific situation and determine if our approach might be a good fit for your needs.

Contact us today to schedule your discovery call and take the next step toward retirement confidence.

Ready for Your Next Chapter?